Federal Form 8962 Premium Tax Credit TaxFormFinder 2022

Overview of Form 8962: Premium Tax Credit

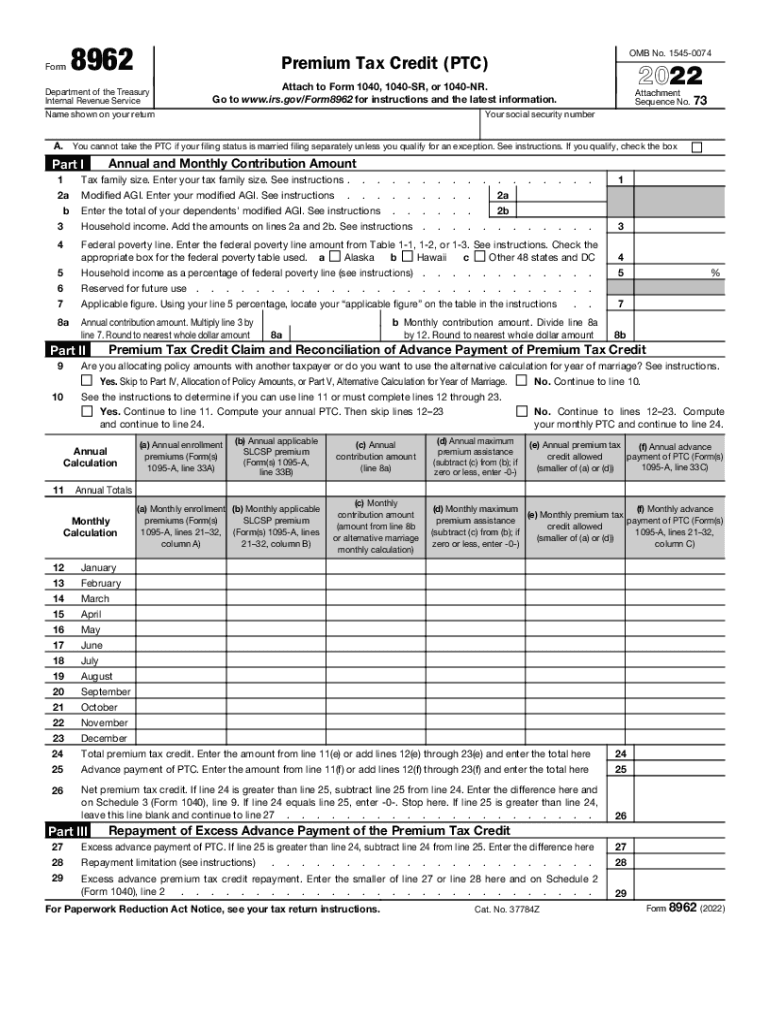

The IRS Form 8962 is essential for individuals and families seeking to claim the Premium Tax Credit, which helps lower the cost of health insurance purchased through the Health Insurance Marketplace. This form is used to reconcile the advance payments of the premium tax credit made on behalf of the taxpayer and to determine the final amount of the credit for the tax year. Understanding how to properly fill out this form is crucial for ensuring compliance and maximizing potential tax benefits.

Steps to Complete Form 8962

Completing Form 8962 involves several key steps:

- Gather necessary documents, including Form 1095-A, which reports the health insurance coverage obtained through the Marketplace.

- Provide personal information, including your name, Social Security number, and the tax year for which you are filing.

- Calculate the premium tax credit using the information from Form 1095-A, ensuring that you accurately report the monthly premium amounts and any advance payments received.

- Complete the required sections of Form 8962, including Part I for the Premium Tax Credit and Part II for reconciling advance payments.

- Review the form for accuracy before submitting it with your tax return.

Eligibility Criteria for the Premium Tax Credit

To qualify for the Premium Tax Credit, taxpayers must meet specific eligibility criteria:

- Must have purchased health insurance through the Health Insurance Marketplace.

- Must have a household income between one hundred and four hundred percent of the federal poverty level.

- Must not be eligible for other affordable health coverage, such as Medicaid or Medicare.

- Must file a federal tax return for the year in which the credit is claimed.

Required Documents for Form 8962

When filling out Form 8962, certain documents are necessary to ensure accurate reporting:

- Form 1095-A: This form is provided by the Health Insurance Marketplace and details the coverage and premium amounts.

- Tax return: Your completed federal tax return, including any other relevant forms and schedules.

- Income documentation: Pay stubs, W-2s, or other proof of income to verify eligibility for the Premium Tax Credit.

Filing Deadlines for Form 8962

It is important to be aware of the filing deadlines associated with Form 8962:

- The form must be submitted along with your federal tax return, typically due on April fifteenth of the following year.

- If you file for an extension, ensure that Form 8962 is included in your extended return by the new deadline.

Legal Use of Form 8962

Form 8962 is legally binding when completed accurately and submitted on time. Compliance with IRS regulations is essential to avoid penalties. The form must be signed and dated, and any discrepancies in reported income or coverage can lead to audits or additional tax liabilities. Using a reliable eSignature solution can help ensure that your submission is secure and legally recognized.

Quick guide on how to complete federal form 8962 premium tax credit taxformfinder

Complete Federal Form 8962 Premium Tax Credit TaxFormFinder effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-conscious substitute for traditional printed and signed papers, as you can access the necessary format and safely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and eSign your documents swiftly and without hold-ups. Handle Federal Form 8962 Premium Tax Credit TaxFormFinder on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

The simplest way to modify and eSign Federal Form 8962 Premium Tax Credit TaxFormFinder seamlessly

- Obtain Federal Form 8962 Premium Tax Credit TaxFormFinder and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Federal Form 8962 Premium Tax Credit TaxFormFinder and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct federal form 8962 premium tax credit taxformfinder

Create this form in 5 minutes!

People also ask

-

What is form 8962 and why is it important?

Form 8962, also known as the Premium Tax Credit form, is used to calculate the premium tax credit that can help lower the cost of health insurance. Accurate completion of form 8962 is crucial for reconciling premium tax credits received against your actual income and household size.

-

How can airSlate SignNow assist me with form 8962?

airSlate SignNow offers an easy-to-use platform that allows you to securely send, eSign, and manage documents, including form 8962. Our solution simplifies the process of gathering signatures and ensures that your form 8962 is completed accurately and efficiently.

-

What features does airSlate SignNow provide for managing form 8962?

With airSlate SignNow, you can enjoy features such as customizable templates, automated workflows, and secure eSigning, all tailored for form 8962. These features reduce time spent on paperwork and help you stay organized during tax season.

-

Does airSlate SignNow integrate with tax preparation software for form 8962?

Yes, airSlate SignNow integrates seamlessly with various popular tax preparation software, making it easier to complete and submit form 8962. This integration helps streamline your workflow, ensuring all your tax documents are in one place.

-

Is airSlate SignNow cost-effective for businesses dealing with form 8962?

Absolutely! airSlate SignNow offers competitive pricing plans that empower businesses to manage documents like form 8962 without breaking the bank. With our cost-effective solution, you can signNowly reduce the expenses related to printing and mailing.

-

What security measures does airSlate SignNow have for documents such as form 8962?

airSlate SignNow prioritizes security with features like secure encryption and compliance with industry standards to protect your documents, including form 8962. You can feel confident that your sensitive information is safeguarded throughout the signing process.

-

Can I use airSlate SignNow on mobile to manage form 8962?

Yes, airSlate SignNow is fully functional on mobile devices, allowing you to manage and eSign form 8962 anytime, anywhere. Our mobile-friendly platform ensures you stay productive even on the go, making tax season more convenient.

Get more for Federal Form 8962 Premium Tax Credit TaxFormFinder

- Landlord tenant notice 497322252 form

- Oh landlord 497322253 form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497322254 form

- Letter from tenant to landlord containing notice that premises leaks during rain and demand for repair ohio form

- Letter from tenant to landlord containing notice that doors are broken and demand repair ohio form

- Letter from tenant to landlord with demand that landlord repair broken windows ohio form

- Letter tenant landlord 497322258 form

- Oh tenant landlord form

Find out other Federal Form 8962 Premium Tax Credit TaxFormFinder

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe